Union County Development Organizations

Union County Community Improvement Corporation

The Union County Community Improvement Corporation (CIC) has unique economic development capabilities that include the ability to borrow money, purchase and lease land and buildings, purchase and lease personal property, and issue bonds or notes.

- The economic development arm of Union County, driving community growth and business viability.

- Offers unique capabilities like issuing bonds, purchasing/leasing property, and borrowing funds for development.

- Supports business retention, marketing initiatives, and economic development programs.

- Envisions a smart-growth economy that blends manufacturing, research, agriculture, and retail.

Union County - Marysville Port Authority

The Marysville-Union County Port Authority is a governmental entity that facilitates economic development projects by leveraging its powers and tax-exempt status to provide cost savings. It offers various financing tools, for purposes such as land acquisition and infrastructure upgrades.

- A government entity with powers in real estate development, financing, and foreign trade zone management.

- Supports economic development by leveraging tax-exempt status and offering financing tools.

- Can acquire and develop land or buildings for business use, enhancing regional competitiveness.

- Provides municipal tax incentives tied to job creation, payroll growth, and private investment.

Stakeholders and Partners

Union County’s growth is powered by strong partnerships. Our stakeholders and partners provide essential resources, incentives, and support to help businesses thrive, innovate, and create lasting economic impact.

Performance Standards

Positive Economic Impact

Driving sustainable growth that strengthens Union County’s economy, creating lasting prosperity for businesses and residents alike.

Quality careers

Empowering our workforce with high-paying, future-focused jobs that elevate careers and enhance our community’s standard of living.

Target Industries

Strategically attracting and supporting industries that align with Union County’s strengths, ensuring long-term economic vitality and innovation.

Competitve Incentives

Offering tailored incentives that give businesses the edge they need to thrive and expand in Union County.

Community Involvement

Fostering strong partnerships between businesses, local leaders, and residents to build a community where everyone benefits from economic success.

Local Incentives

Union County’s countywide programs are driving the future of economic growth by fostering innovation, attracting key industries, and creating high-quality jobs.

Economic Development Incentives Policy

An expanding economy is critical to increasing the health and well-being of all Union County communities. Union County and various local entities (“stakeholders”) recognize the need to provide incentive programs and financial support to strengthen and diversify the County’s economy.

Union County Enterprise Zone Program

The Union County Enterprise Zone Program offers real property tax abatements for eligible companies wanting to expand or locate within the designated Enterprise Zone areas that are in the City of Marysville, the Village of Richwood, and portions of southern Union County. The term and amount of the tax abatement are based upon the number of employees, amount of payroll, and amount of investment.

Municipal Income Tax Rebate Program

For those jurisdictions which levy municipal income taxes or any area in which a Joint Economic Development District (JEDD) has been created, municipal income tax rebates can be given to a company in return for job creation, payroll generation, and private investment. The municipal income tax rebate works where a company agrees to private investment into real and personal property, creation of jobs, and personal income tax from the created jobs. After the company provides the projected income taxes meeting the agreement for a calendar year, the appropriate jurisdiction agrees to rebate the company a certain percentage (50% or less) of the personal income taxes collected.

Tax Increment Financing (TIF)

For select major industrial, office, or commercial properties, the County or appropriate jurisdiction could employ tax increment financing to raise revenues necessary to finance required capital improvement projects (i.e. all public infrastructure including but not limited to roadway or utility extensions). Working closely with the developer, the County or jurisdiction establishes a development area where the development project is planned. Public infrastructure improvements are performed and real property taxes collected on the new development in the development area are used to pay the debt service on the infrastructure improvements.

Foreign Trade Zone

A Foreign Trade Zone (FTZ ) is a site within the United States that is legally considered outside of Customs territory for the purpose of duties, so goods may be brought into the site duty-free and without formal customs entry. Union County is a subzone of the Rickenbacker FTZ #138. There are a number of benefits of being a part of an FTZ. For more information, please visit the FTZ #138 website or download more information.

Union County

Union County is a hub for business growth, offering strategic reinvestment programs and incentives that drive innovation, job creation, and economic expansion. With a pro-business environment, strong community partnerships, and targeted financial support, Union County provides the resources companies need to invest, grow, and succeed.

Southern District Enterprise Zone

The Southern District Enterprise Zone offers businesses a strategic advantage in Paris, Union, and Jerome Townships. These designated areas provide opportunities for tax incentives making them ideal locations for businesses to expand or establish operations in Union County. With prime locations, strong infrastructure, and pro-business attitude, the Enterprise Zone fosters growth and investment while strengthening the local economy.

.avif)

.avif)

Marysville

Marysville drives growth through targeted reinvestment programs, offering tax abatements to spur development, job creation, and modernization. From Uptown revitalization to the Marysville Innovation District and North Main Corridor, these incentives make Marysville a prime destination for businesses ready to expand.

.avif)

Marysville Community Reinvestment Area #1

In an effort to improve its uptown and surrounding neighborhoods, the City of Marysville established the Marysville Community Reinvestment Area to provide real property tax abatements for eligible residential, commercial, office, and industrial development. The term and amount of the abatements vary depending on the land use, the number of jobs created or retained, the amount of payroll, and the amount of the investment.

Learn More.avif)

Marysville Innovation District Reinvestment Area

In 2019, the City of Marysville established the Marysville Innovation District Community Reinvestment Area to provide real property tax abatements for eligible residential, commercial, office, and industrial development in the southern portions of the city, including the 33 Innovation Park. The term and amount of the abatements vary depending on the type of project, the number of jobs created or retained, the amount of payroll, and the amount of the investment.

.avif)

North Main Corridor Community Reinvestment Area

The North Main Corridor Community Reinvestment Area in Marysville, Ohio, is designed to encourage investment and revitalization through property tax incentives for qualifying projects. With its prime location along a key corridor in Marysville, the program supports growth, modernization, and economic development, making it an attractive option for those looking to invest in the community.

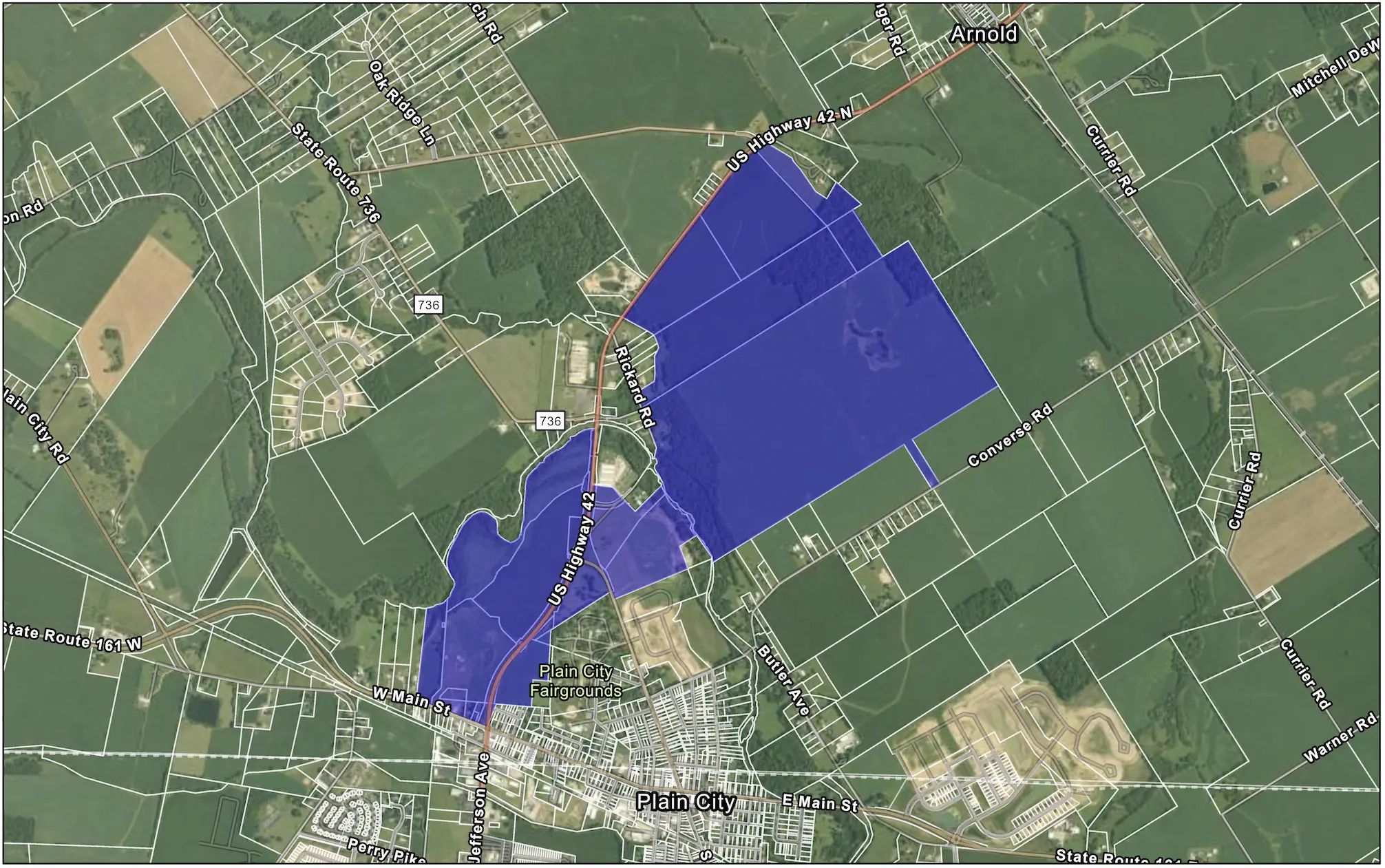

Plain City

US-42 North Community Reinvestment Area fuels business expansion with strategic tax incentives. The newly expanded CRA now includes Creekview Commerce Park, supporting commercial and industrial growth while making it easier for businesses to invest, create jobs, and thrive in this rapidly growing region.

Creekview Commerce Park: Sustainable Growth for Plain City

Led by Highland Real Estate (Columbus), Creekview Commerce Park is a proposed, sustainability-minded development designed to bring jobs, investment, and long-term economic value to Plain City and the surrounding region. The plan emphasizes environmentally conscious design and alignment with the community’s strategic vision. The Village is committed to open communication—whether you’re a resident with questions or a business exploring a location within the park. We’ll share regular updates on key milestones and next steps. Contact Jason Stanford (jstanford@plain-city.com) with any questions

Richwood

Richwood’s Community Reinvestment Area and Richwood-Claibourne Township Enterprise Zone offer tax incentives to fuel business growth and job creation. These programs provide financial benefits for new and expanding businesses, making northern Union County a prime destination for investment and development.

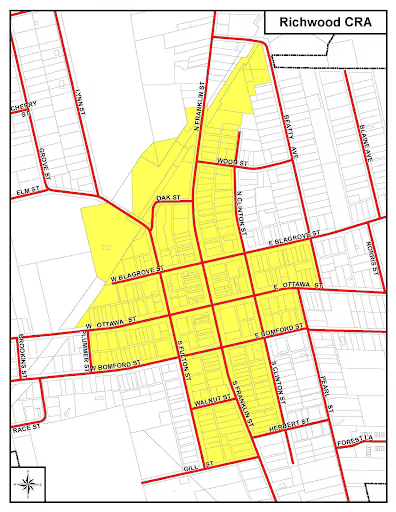

Richwood Community Reinvestment Area

The Village of Richwood established a Community Reinvestment Area (CRA) to provide real property tax abatements for eligible residential, commercial, office, and industrial development occurring within a specific geography of the village. The term and amount of the abatements vary depending on the land use, the number of jobs created or retained, the amount of payroll, and the amount of the investment.

.avif)

Richwood-Claibourne Township Enterprise Zone

The Richwood-Claibourne Township Enterprise Zone provides businesses with valuable tax incentives to promote economic growth and job creation in northern Union County. This designated area supports new and expanding businesses by offering financial benefits that encourage investment in infrastructure, facilities, and workforce development. With its business-friendly environment and strong community support, the Richwood-Claibourne Township Enterprise Zone is an excellent opportunity for companies looking to establish or grow their operations in Union County.

Ohio

Ohio Means Jobs - Union County connects businesses with top talent through job placement, applicant screening, and interview support. For industrial and office developments, OMJ also offers workforce training assistance, ensuring companies have the skilled employees needed to grow and succeed.

Ohio Means Jobs - Union County

Ohio Means Jobs-Union County (OMJ) assists companies with employee job placement, applicant screening, and applicant interviewing. For industrial or office developments, OMJ can also provide in-kind or, in some cases, financial assistance to companies to establish job training programs for new employees that will be hired as a result of the development.

Stay in touch!

Get notified with the latest updates, offers, events, and all the amazing news from UCED. Delivered straight to your inbox!